Guest Blog

How States Can Accelerate Renewable Buildout for Tax Credits

November 24, 2025

This blog was co-written by the World Resources Institute (WRI) and NCEL.

Overview

The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, introduced significant changes to tax credits for clean energy projects. In response, some states have taken actions to speed up renewable development or aid impacted projects before certain rules come into effect. This blog explores recent actions by states and how state legislators can accelerate renewable deployment to maximize benefits.

What Are the New Rules For Key Clean Energy Tax Credits?

The OBBBA’s changes to federal clean energy tax credits vary, but the law largely eliminates or accelerates the expiration of many federal clean energy tax credits. Most projects use one of two tax credits known as the investment tax credit (ITC) and the production tax credit (PTC). The most critical changes for projects claiming these credits are:

- Tax Credit Eligibility for Wind and Solar Projects: Wind and solar projects that begin construction (as defined in IRS guidelines) after July 4, 2026 must be placed in service by December 31, 2027 to claim the ITC or PTC. Projects that begin construction on or before July 4, 2026 have four years after their start of construction date to be placed in service to claim either credit.

- Foreign Entities Of Concern (FEOC) Requirements: To be eligible to receive the ITC or PTC, any projects that begin construction after December 31, 2025 must follow rules regarding regulating ownership, payments to, and material assistance from governments, companies, and people from “foreign entities of concern” (FEOCs) like North Korea, Russia, Iran, and China.

- Tax Credit Eligibility for Other Clean Energy Sources: Storage, geothermal energy generation, hydro, nuclear, and other clean energy technologies may continue to claim the ITC or PTC if they begin construction by December 31, 2035.

What Are States Doing to Help Wind, Solar, and Other Clean Energy Projects?

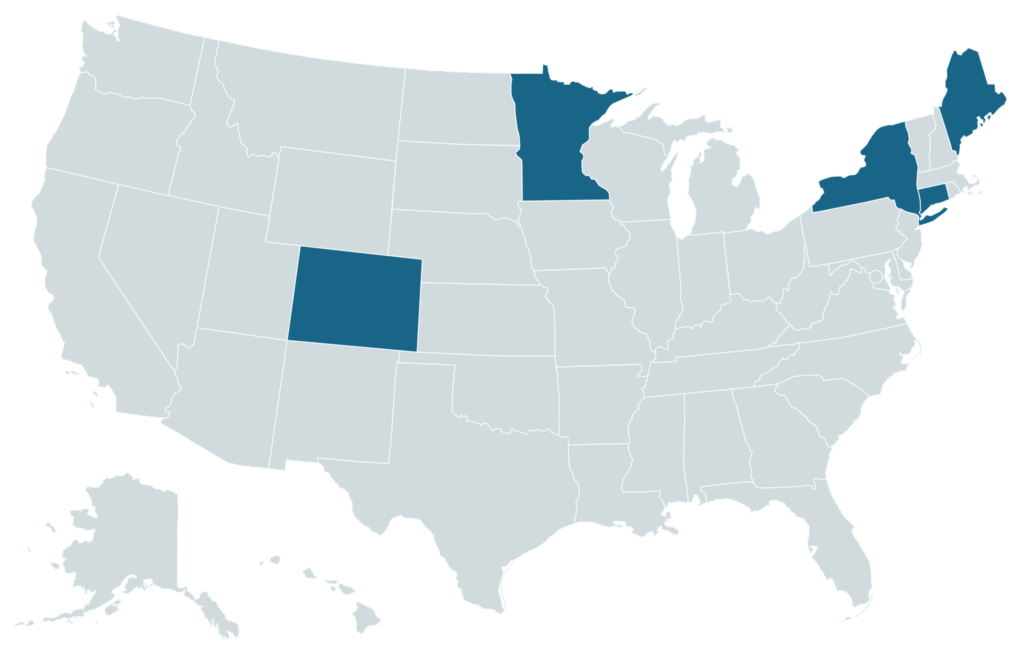

In recent months, states have been responding with executive and regulatory actions to keep renewable energy projects eligible under the OBBBA’s new tax credit rules. Click the dropdown menu below to see the types of actions states have taken.

State Action on Clean Energy Tax Credits

- Colorado – Governor Letter: On August 1, 2025, Colorado Governor Jared Polis issued a letter outlining how the state would work to support accelerated buildout of clean energy. Soon after, Xcel Energy and state agencies filed a motion to initiate a near-term procurement process for up to 4,000 MW of renewable energy projects. The motion specifically cited changes to tax credits from OBBBA and the governor’s letter as main drivers behind this request.

- Connecticut – Request for Proposal (RFP): On September 10, 2025, Connecticut released a request for proposal for late-stage wind, solar, and co-located storage projects at risk of losing tax credits. The RFP invited other New England states to join and evaluate proposals using their own criteria to improve project viability through information sharing and demand pooling. In October, the Maine Public Utilities Commission voted to join the solicitation.

- Maine – Request for Proposal (RFP): On July 14, 2025, the Maine Public Utilities Commission (MPUC) issued a Request for Proposal (RFP) to procure up to 1,600 GWh of renewable energy from projects developed on contaminated farmland. In response to changes from OBBBA, the MPUC fast-tracked solicitation of projects by making RFPs due on July 25. On September 16, the MPUC announced that it had selected five projects for approval under the RFP: one hydropower project with four MW of capacity and four solar facilities totaling 257 MW of capacity.

- Minnesota – Public Utilities Commission Order: On August 7, the Minnesota Public Utilities Commission (MNPUC) issued an order requiring utilities to file plans for accelerating construction and place-in-service dates for clean energy projects to maximize tax credit value. The order also asked utilities to suggest “supportive actions the Commission or other state regulatory bodies could take to mitigate” effects from tax credit changes.

How Can State Legislators Take Action to Speed Up Renewable Development?

While most of the actions undertaken so far to enable expedited renewable procurement have taken place at the executive or regulatory level, state legislators can take many actions to help speed wind and solar projects in their state. States can:

- Authorize or encourage competitive near-term solicitations for renewable energy. As seen in Connecticut, New York, and Maine, running near-term procurement solicitations directly supports large-scale, late-stage renewable energy projects by providing financial guarantees and technical assistance to help them begin construction or be placed in service within the new deadlines. Learn more about state policies for renewables.

- Require utilities to undertake and demonstrate plans for accelerating development of renewable energy generation. As seen in Minnesota, requiring utilities to create and share plans for speeding up development can leverage existing technical, procurement, and financial expertise to move larger projects along more quickly. Learn more about state policies for utilities and renewables.

- Reduce permitting timelines and costs or authorize expedited review and assistance. Working to change permitting processes, shorten timelines, and reduce permitting costs can help developers begin construction more quickly, and many states have been exploring ways to do this. In the absence of larger reforms that may take time to deliberate, however, state legislators can authorize expedited reviews for projects impacted by federal tax guidance and create programs to provide technical assistance to developers. Learn more about permitting for renewables.

- Support expansion of distributed energy resources (DERs) to take advantage of tax credits. Smaller-scale projects are better positioned to start and finish construction by the December 2027 timeframe than large projects. Lawmakers can help their constituents take advantage of this by supporting residential and commercial solar and storage, incentivizing community renewable projects, and encouraging demand-side solutions like virtual power plants (VPPs) and large-scale behind-the-meter generation.

Looking Ahead

By acting quickly with streamlined procurement, supportive policies, and collaborative frameworks, states can ensure renewable projects maximize tax credit opportunities and accelerate the clean energy transition. To learn more, contact NCEL Climate and Energy Program Manager Ava Gallo or WRI Clean Energy Specialist Ian Goldsmith.