NCEL Blog

The Road to Electrification: Consumer Purchasing

January 15, 2020

The future is electric! At least that’s the hope for many seeking to modernize how folks move around while reducing greenhouse gas emissions. The transportation sector alone is a huge contributor of GHGs in the US and recently surpassed the electric power sector as the top emitter. Promisingly, the share of fully electric and hybrid vehicles has been steadily growing thanks in part to new models appealing to consumer interest and price points. More so than not, though, this growth is thanks to government policies stimulating the market.

State governments, in particular, have played a significant role in that stimulus. From improving charging infrastructure to allowing HOV lane access, states are utilizing a suite of policies that have made owning and driving an EV more feasible for everyday consumers. In our new blog series, The Road to Electrification, we’ll be taking a look at these different policies in detail and provide resources to help you advance similar efforts in your state. Up first, let’s take a look at what states can do to improve consumer purchasing.

Aiding Consumer Purchase

For many people, the cost of purchasing an EV, let alone a new vehicle, is still a hurdle to overcome. That’s why purchasing incentives like tax credits and rebates at both the state and federal level have been a big part of EV market growth. For the foreseeable future, however, states will have to step-up these incentive programs now that the federal government is phasing out it’s $7,500 electric vehicle tax credit.

States like Maryland, which launched a $3,000 excise tax credit (HB 1246) for purchasing electric or fuel cell vehicles last year, are leading the way. In fact, the Maryland program was so popular that it quickly ran out of funding for the budget term due to high demand. Other states have similar incentives, with Colorado having the highest among them at $5,000, which was just extended to 2026 to avoid sunsetting this year. Colorado’s incentive is particularly unique in that a new buyer can assign the tax credit at the time of sale directly to the dealer or finance company, they don’t have to wait for the rebate!

It’s important to note that the market is just as sensitive to state incentives as it is federal ones. For instance, in 2015 the state of Georgia repealed its popular $5,000 tax incentive and instituted a $200 registration fee for new purchases. Immediately following that, EV sales dropped by 80% and haven’t recovered since. Thankfully, a bipartisan group of GA legislators introduced a bill this year, HB 732, that would provide a tax credit of up to $2,500 for a lease or purchase of a qualified vehicle. The bill also includes a credit for business and residential installation of EV chargers.

Improving Consumer Access

Cushioning the initial investment in a vehicle is great for consumers but what if there’s not a diverse enough spread of EV models people want to buy to begin with? Though odd, it’s a reality today. Just take a look at the case of Tesla Motors.

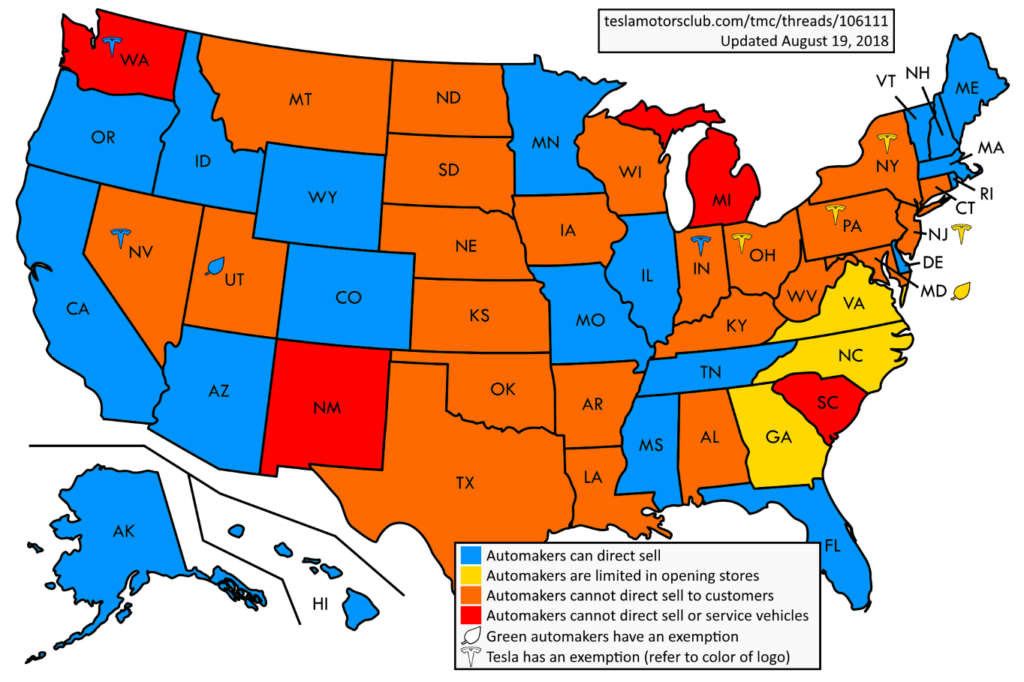

Traditional car manufacturers, like Ford and GM, didn’t initially produce the array of alternative fuel vehicles they have on the market now. For a while, boutique developers like Tesla were leading the way in EV manufacturing. However, the franchise model for selling cars, where dealerships act as the middle-man between the manufacturer and the consumer, limited Tesla and other’s reach into the market. Dealerships were hesitant to sell cars they thought people wouldn’t buy. They also didn’t have the technical capacity to handle repair and inspection for an entirely different class of vehicle. Efforts to skip the middle-man by Tesla were also met with legal roadblocks since many states have laws that make direct sales by any car manufacture illegal – a protective holdover from the great depression. Where it could, Tesla was limited to setting up its own storefronts in a handful of states that allowed direct sale.

Over time, rounds of legal battles and legislative victories broadened the number of states allowing direct sales to over 20 today. That leaves a patchwork of states that have either banned direct sale outright, or restricted it to select manufacturers with a limited number of storefronts. Put simply, the state of the market is unfair to new and up-and-coming EV companies, like Tesla once was. States can improve competition and broaden consumer choice by allowing more EV manufacturers to sell their vehicles directly to consumers, like Colorado tried to do through HB19-1325 in 2019.

Another option is to push the established automotive industry to produce EVs, just like the Zero Emission Vehicle (ZEV) Mandate does. First instituted in California, then adopted by ten other states, the mandate requires manufacturers to produce a percentage of EV and alternative fuel vehicles based on their total sales. By doing so, the mandate ensures that new vehicles are put on the market and, in principle, promotes more adoption by consumers long-term. The states that have adopted the ZEV mandate make up about 30% of average annual car sales alone. Imagine what the impact would be if more states adopted the mandate.

State Fleets and School Buses

State governments can lead by example through the conversion of their vehicle fleets to EVs or plug-in hybrids. Washington state, thanks to a bill passed last year (ESHB 1160), is in the works of conducting an analysis of the feasibility of converting city, county, state, and public transit vehicles to EVs. Oregon passed a similar bill, SB 1044, requiring that 25% of new light-duty vehicles purchased or leased by state agencies to be zero-emission vehicles by 2025, and 100% by 2029.

At a localized level, Nevada and Maryland passed legislation that creates grant programs to support school districts in purchasing EV buses and installing charging infrastructure. Programs like these have been garnering more public support thanks to the public health benefits that arise from reductions in asthma-inducing emissions in communities. Arizona also started up a program after Governor Ducey allocated $38 million from Volkswagen settlement funds.

Many states have been utilizing Volkswagen settlement funds to invest in converting their fleets to EVs and establish grant programs to help communities implement clean transportation infrastructure. Though, not all states have been utilizing these funds as effectively as they could. USPIRG looked at how every state plans to use their share of the funds and scored them based on their efforts. Only seven states (WA, HI, RI, VT, CA, MA, and NY) receiving a B or better in their scoring, noting that some funds are going into supporting traditional fossil fuel technologies instead of advancing battery-powered alternatives. You can see how each states’ plans compare here.

Takeaways

Modern transportation systems are biased towards fossil-fueled vehicles and changing that requires some well-placed incentives to shift consumer attitudes. States have the power to do that effectively and in a lot of creative ways too. In the next installment, we’ll look at how states are working to resolve another hurdle to broader EV adoption: range and charging anxiety