Issue Brief

Green Banks and the Inflation Reduction Act

Overview

This Issue Brief is intended to give an overview of green banks as tools to accelerate the transition to clean energy and fight climate change, with a specific focus on their connection to the recently enacted Inflation Reduction Act (IRA). The full Issue Brief includes a green banks overview section, information on the connections between green banks and the Inflation Reduction Act, sample state green bank legislation, steps state lawmakers can take to create a green bank, and additional resources.

What Are Green Banks?

Green banks are mission-driven institutions that use innovative financing to accelerate the transition to clean energy and fight climate change. Despite the word “bank” in the name, green banks do not take deposits. They function like loan or investment funds, using a wide array of financial tools to support investment in clean energy infrastructure. Green banks differ in governance from state to state. Some are fully public entities, some are “quasi-public” entities with independent governance structures, and some others are fully independent entities without formal ties to the state. Green banks aim to be financially sustainable, but they are not profit-maximizing. They focus instead on using their capital to mobilize as much overall investment as possible to achieve their goals.

The Connection to the Inflation Reduction Act

How does the Inflation Reduction Act support green banks?

The Inflation Reduction Act creates a new grant program entitled the Greenhouse Gas Reduction Fund (GHGRF). The Greenhouse Gas Reduction Fund has been split into three buckets:

- National Clean Investment Fund: $14 billion will be allocated to 2 or 3 larger national nonprofits that will partner with private capital providers to deliver clean technology financing at scale to businesses, communities, community lenders, and others.

- Clean Communities Investment Accelerator: $6 billion will be allocated to 2-7 nonprofits to to build the clean financing capacity of networks of community lenders specifically in low-income and disadvantaged communities.

- Solar for All: $7 billion will provide up to 60 grants to States, Tribal governments, municipalities, and nonprofits for low-income and disadvantaged communities to access solar investment.

How are state green banks important to the implementation of the Inflation Reduction Act?

While states are directly eligible to apply for the Solar for All Funds, the National Clean Investment Fund and the Clean Communities Investment Accelerator ($20 billion of the funds) must be given to nonprofit entities. These nonprofit entities must in turn invest indirectly in green projects through other local financing entities. State governments that have not created green banks (or public entities that fulfill a very similar function) will struggle to access this $20 billion. States without green banks will have less clear entities to compete for these two funds and might defer responsibility to nonprofit and not-for-profit financing institutions (such as CDFI loan funds, CDFI credit unions, and independent nonprofit green banks) while states that have created green banks will be able to influence decisions about how the funds will be used.

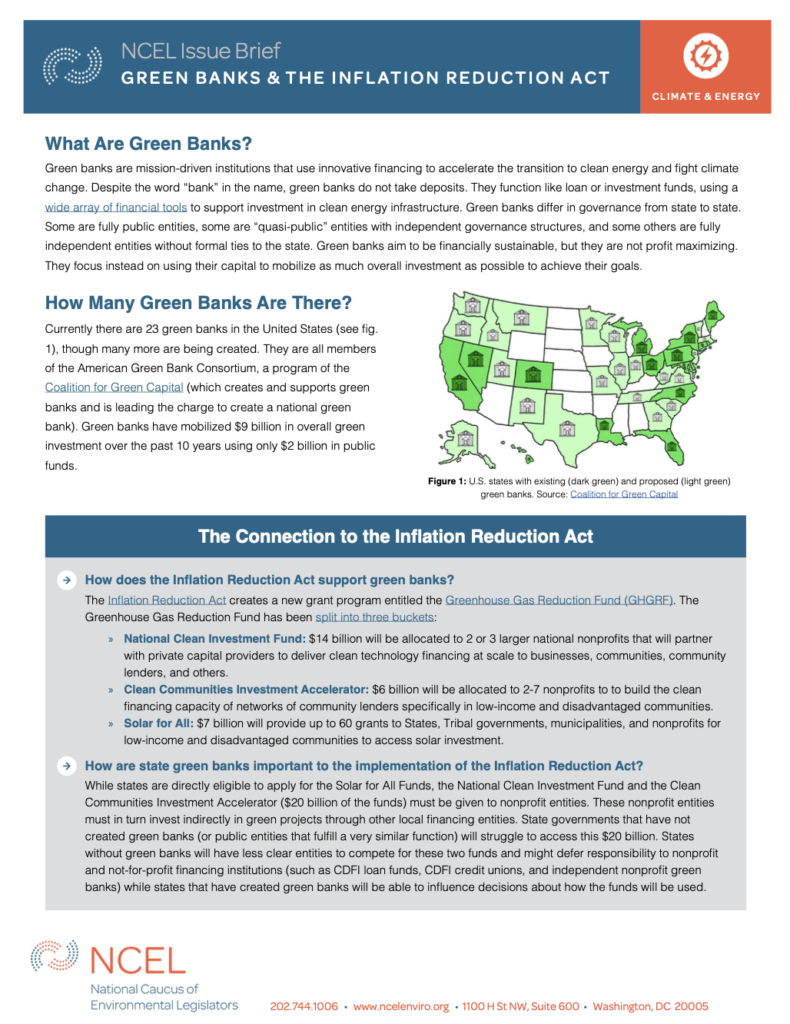

Green Bank Legislation

- **Nevada SB407 (2017): Established an independent, nonprofit corporation called the Nevada Clean Energy Fund (NCEF) to help finance clean energy projects in Nevada. SB 407 also created the Board of Directors and set forth the duties of the Board.

- Colorado SB21-230 (2021): Directed the state treasurer to make an immediate, one-time transfer of $40 million from the general fund to the energy fund administered by the Colorado energy office (CEO). The legislation instructs the CEO to make a grant to the Colorado Clean Energy Fund (Colorado’s green bank) of $30 million.

- Illinois SB2408 (2021): Designated the Illinois Finance Authority as the “Climate Bank” to aid in all respects with providing financial assistance, programs, and products to finance and otherwise develop and implement equitable clean energy opportunities in the State.

Empower State Environmental Champions

Your donation funds the fight for equitable actions that protect the environment and our health.

Donate